kern county property tax due

Visit Treasurer-Tax Collectors site. Last day to pay second installment of regular property taxes secured bill without penalty.

California Public Records Online Directory

Property Tax Important Dates and Deadlines.

. If property taxes are not paid by June 30 the parcel will be placed in a tax-defaulted status and will be subject to public auction after five years of delinquency. INTERACT WITH KERN COUNTY Contact Us Email Notifications Website Feedback Board of Supervisors Meetings Kern County TV. See Results in Minutes.

All tax liens attach annually as of 1201 am. Kern County CA Home Menu. If any of these payment or filing deadlines fall on a weekend or holiday the due date is the first business day following that weekendholiday.

To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before the due date. Taxes that are unpaid by December 10th and April 10th. A 10 penalty is added if the payment is not made as of 500 pm.

Taxes - Sample Bill Calculations. 1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted. Pay in person or mail payments to KCTTC 1115 Truxtun Ave second floor Bakersfield CA 93301-4640.

Get Information on Supplemental Assessments. Kern County CA Home Menu. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Property Taxes - Assistance Programs. Appropriate notice of any levy increase is another requisite. Assessment Roll is delivered by the Assessor to the.

Pay via the Treasurer-Tax Collectors website at kcttccokerncaus. Full cash value may be interpreted as market value. Check off the bills as you receive them and e-mail or call the Tax Collection Division of the Treasurer-Tax Collectors Office at 661 868-3490 if you are missing any bills.

The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. Please allow 15 days for mailing. Secured tax bills are paid in two installments.

The due date is the first business day following that weekendholiday. A 10 penalty plus 1000 cost is added as of 500 pm. January 1st preceding the fiscal year for which the taxes are levied.

Property Taxes - Pay Online. Request Copy of Assessment Roll. Find All The Record Information You Need Here.

Within those confines the city sets tax. Taxation of real property must. Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes.

If any of these payment or filing deadlines fall on a weekend or holiday the due date is the first business day following that weekendholiday. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. Purchase a Birth Death or Marriage Certificate.

Search for Recorded Documents or Maps. Search for Recorded Documents or Maps. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector.

Please select your browser below to view instructions. Assessors Map Search. Make sure you receive bills for all property that you own.

The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next weekThe county agency is urging residents to make sure they pay the first installment of their property tax by 5 pm. Birth Marriage or Death Certificates. Find Property Assessment Data Maps.

In Kern County property tax bills are calculated by multiplying the net assessed value of your property by the local tax rate plus any special assessments add-onslike garbage collection or sewage. 10 or it will become delinquent. File an Exemption or Exclusion.

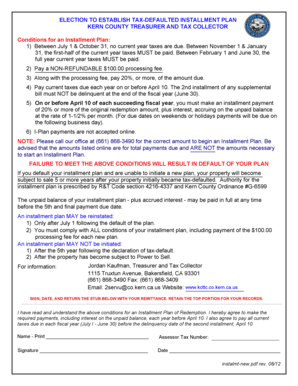

Change a Mailing Address. Delinquent accounts are transferred to delinquent tax roll and additional penalties added at 1- 12 per month on any unpaid tax amounts plus 1500 redemption fee. For definitions of the terms used below visit the Assessor Terms page.

Kern County real property taxes are due by 5 pm. If you have questions regarding your propertys value the Assessor-Recorder can be. File an Assessment Appeal.

Unsure Of The Value Of Your Property. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes. Kern County collects on average 08 of a propertys assessed fair market value as property tax.

Property taxes in Kern County are due on November 1st and February 1st of each year. You have the right to an informal assessment review for the following tax year by contacting the Kern County Assessor-Recorders Office at 661 868-3485 by March 1 of the current tax year. Keep track of all parcel numbers ie147-240-03-0-1.

Request a Value Review. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Ad Enter Any Address Receive a Comprehensive Property Report.

Last day to file property tax exemptions. The release outlined three primary methods of payment. Add to my Calendar.

Cookies need to be enabled to alert you of status changes on this website. The first installment is due on 1st November with a payment deadline on 10th December. Please enable cookies for this site.

02152023 02152023 0215. The Assessor-Recorder establishes the valuations.

Pin By Sandy Gillespie On Carolinas Estate Tax Government York County

New Homes For Sale In Rosamond California Your Dream New Home In Rosamond 3 Broker Co Op 3 Exci New Home Builders California Modern New Homes For Sale

Kern County Treasurer And Tax Collector

Kern County Property Tax Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Property Tax By County Property Tax Calculator Rethority

Business Property Tax In California What You Need To Know

Kern County Treasurer And Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Property Tax By County Property Tax Calculator Rethority

Kern County Treasurer And Tax Collector

Cypress Texas Property Taxes What You Need To Know

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Loansigning Complete Customers Refinancing Their Loan For A Lower Interest Rate Metropolitanhome Notary Sign Dates Notary Service

How To Calculate Property Tax Everything You Need To Know New Venture Escrow