cap and trade vs carbon tax upsc

In 2015 it was further increased to Rs 200. Firms are allotted permits for emissions over a specified time period and companies that pollute less than their allotment can sell their excess.

Carbon Offsets Vs Carbon Credit Harmony Fuels

CARBON TAXESExxons CEO call for a carbon tax.

. And it seems likely. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. The chief executive of Exxon Mobil Corp. With a tax you get certainty about prices but uncertainty about emission reductions.

Consider the following statements. A cap may be the preferable policy when a jurisdiction has a specified. Issue Date August 2013.

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. Goulder and Andrew Schein NBER Working Paper No. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms.

India imposed a Carbon tax of Rs 50 per ton of coal produced and imported in 2010. The EU Emissions Trading System has shown that cap and trade can be extended to carbon and in doing so creates a price on carbon that drives emissions reductions. Because the tax makes using dirty fuels more expensive.

Carbon taxes vs. With a carbon tax there is an immediate cost to. While there are tradeoffs between these two principal market-based instruments targeting CO2 emissions -- a cap-and-trade system and a carbon tax -- the best and most likely approach for the short to.

In 2014 it was increased to Rs 100. I am opposed however to the confused and misleading straw-man arguments that have sometimes been used against cap-and-trade by carbon-tax proponents. Cap and trade allows the market to determine a price on carbon and that price drives investment decisions and spurs market innovation.

Carbon emissions trading known as cap and trade works by imposing a restriction on the amount of emissions that power companies oil refineries and other energy-intensive businesses may emit. Carbon tax is Pigovian tax. Each approach has its vocal supporters.

Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. Theory and practice Robert N. In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden.

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Cap and trade differs from a tax in that it provides a high level of certainty about future emissions but not about the price of those emissions carbon taxes do the inverse. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. Currently the carbon tax is Rs 400 per ton. We show that the various options are equivalent along more dimensions than often are recognized.

More about this program. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so.

The cap and trade system is thus functionally similar to a tax on carbon. Organizations in favor of a cap and trade system. Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is.

Carbon Tax vs. Cap-and-Tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and other industries would have to purchase in order to burn fossil fuels whereas a Carbon Taxthe approach most popular among economistswould discourage emissions reductions by. Cap and Trade.

With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own. You can do the same to cap-and-trade. The Cap-and-Trade Program is a key element of Californias strategy to reduce greenhouse gas emissions.

You can tweak a tax to shift the balance. H23Q50Q54 ABSTRACT We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. A carbon tax and cap-and-trade are opposite sides of the same coin.

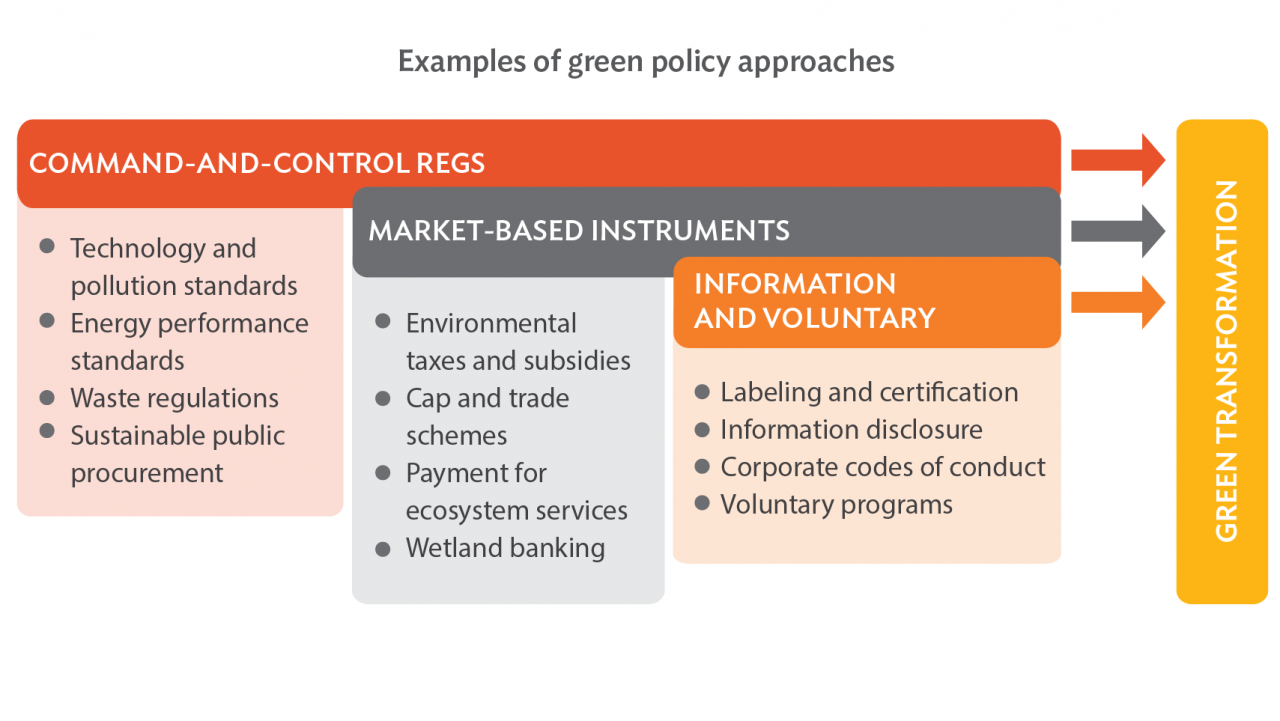

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. A Critical Review Lawrence H. Carbon Tax vs.

For the first time called on Congress to enact a tax on greenhouse-gas emissions in. Carbon tax is based on the polluter pay principle. Carbon Tax India.

April 9 2007 413 pm ET It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. Finland is the first country to. Carbon tax is a form of pollution tax.

With a cap you get the inverse. Cap and trade on the other hand aims to put a. 19338 August 2013 JEL No.

Peter MacdiarmidGetty Images G r. Cap and trade has proven its effectiveness in the US through the acid rain program where it quickly and effectively reduced pollution levels at a far lower cost than expected. Environmental Defense chief scientist Bill Chameides wrote a piece in Gristmill as well laying out the case for a cap and trade system.

The debate between Carbon Tax and Cap and Trade is an important one that could lead to new federal legislation by the end of the year. The theory behind the carbon tax is that it provides an incentive for businesses to start using cleaner fuels as it becomes too expensive to continue polluting carbon into the atmosphere. It complements other measures to ensure that California cost-effectively meets its goals for greenhouse gas emissions reductions.

Both can be weakened. The government sets a price per ton on carbon and then translates it into a tax on electricity natural gas or oil. It levies a fee on the production distribution or use of fossil fuels based on how much carbon their combustion emits.

Carbon Emissions Trading Need Working Pros Cons Alternatives Upsc Ias Express

In Depth Q A How Article 6 Carbon Markets Could Make Or Break The Paris Agreement Carbon Brief

This Was Made For A Friend Who Qualified For The Deutsche Bank S Ideatrix Competition Carbon Sequestration Work Infographic

The Eu Emissions Trading System An Introduction Climate Policy Info Hub

Environmental Economics The Coase Theorem Britannica

Iasbaba S Daily Current Affairs 29th December 2016 Water Crisis Best Water Filter Current

Carbon Credits Vs Carbon Offsets What S The Difference One Tree Planted

Carbon Offsets Vs Carbon Credit Harmony Fuels

The Eu Emissions Trading System An Introduction Climate Policy Info Hub

Carbon Offsets Vs Carbon Credit Harmony Fuels

Carbon Trading How Does It Work Bbc News

What Is Carbon Pricing And Carbon Credit Definition Countries Trends

The Eu Emissions Trading System An Introduction Climate Policy Info Hub

Carbon Emissions Trading Need Working Pros Cons Alternatives Upsc Ias Express

Carbon Credit An Overview Sciencedirect Topics

The Eu Emissions Trading System Seeking To Improve Climate Scorecard

How Can Policy Makers Promote Green Business Development Asia